Source: Minlay

Adagia Partners, a leading European mid-market private equity fund manager, is pleased to announce the entry into exclusive negotiation with Motion Equity Partners to acquire alongside management, Minlay SAS (“Minlay”, or the “Group”), one of the leading European providers to dental surgeons of high-quality prosthetics and value-add services.

Both parties have agreed not to disclose any information on the details of the transaction.

Founded in 2006, Minlay is the French leader in the manufacturing and distribution of dental prosthetics with further presence in Germany and the Netherlands.

Positioned in the premium segment of the market, Minlay’s offer addresses all the dentist’s needs, from fixed prosthetics to removable devices. The Group’s strong expertise and operational know-how enables it to meet the dentists’ highest expectations in terms of product and service quality. Headquartered in Paris, the group is composed of 16 labs operating under 12 recognized and differentiated brands – all unified by their processes and tools. It employs 440 people across three countries.

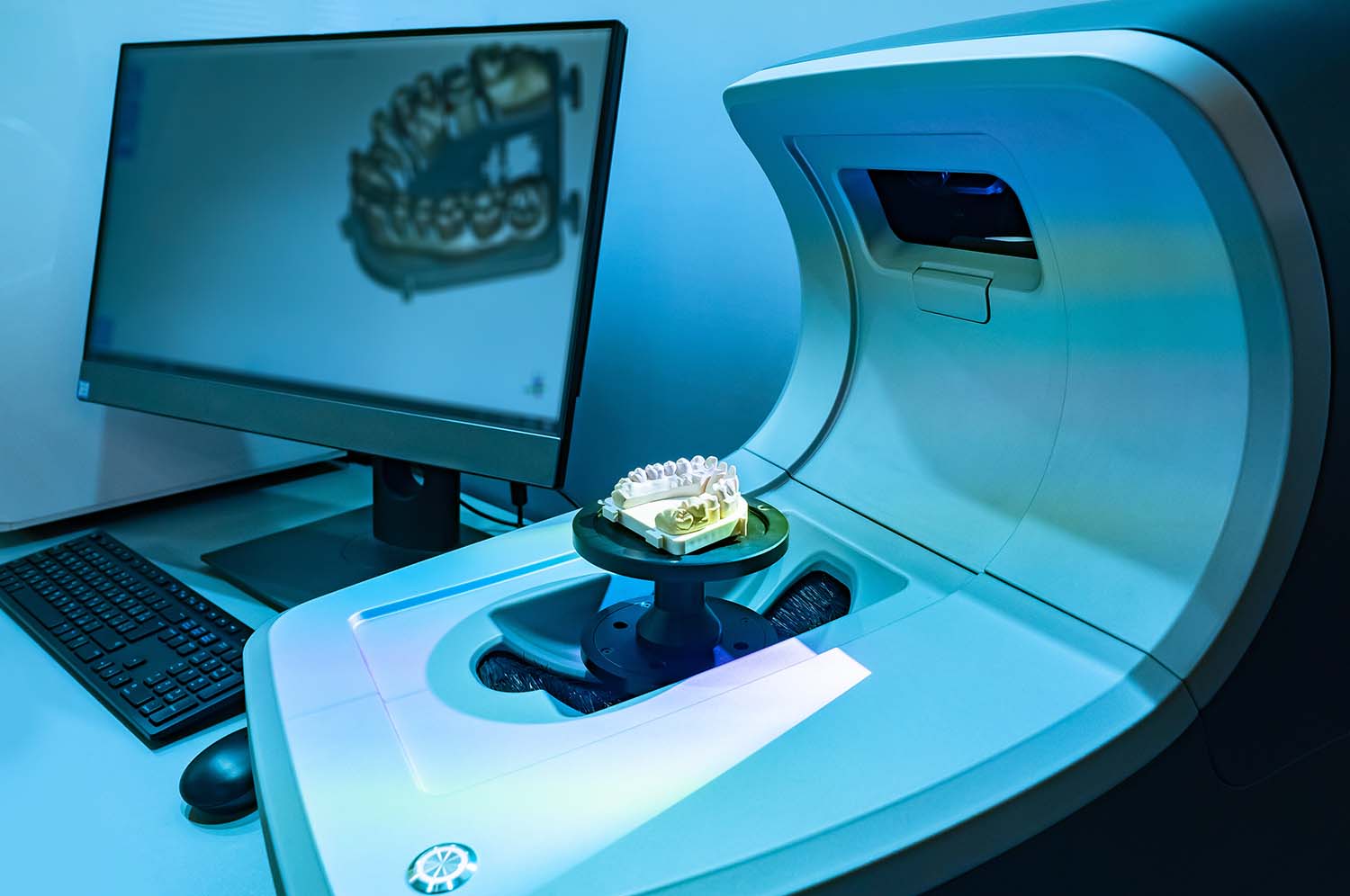

Minlay’s success relies on the effective roll-out of innovative proprietary processes and tools across the Group’s lab networks notably with CAD/CAM processes, ISO certifications and in-house ERP systems.

The Group has successfully expanded through a dynamic buy-and-build strategy to become the market leader addressing all customers segments.

Healthcare is one of Adagia Partners’ three core sector focus. With the support of Adagia Partners, the management team’s ambition is to continue expanding its footprint across France through an aggressive roll-out of its existing business model, as well as targeting acquisitions and expanding into other European countries where attractive market opportunities have been identified.

“We are looking forward for our next growth phase together with the Adagia Partners team. We have been convinced over past months of the value Adagia Partners can bring on the execution of our growth strategy: dental industry knowledge, industrial M&A, internationalization and technology approach. Our ambition is to continue to expand our French footprint and geographical reach in the years to come and become the European leader with their support.”

Eric Darrou – CEO of Minlay

“After Schwind eye-tech-solutions, Minlay is the second deal of Adagia Partners. We are delighted to partner with a rapidly growing company led by a strong and ambitious management team. Minlay fits perfectly with our investment focus. The group is positioned on a growing market supported by long term positive trends and exhibits defensive features. Minlay is already the leader in France and enjoys a strong recognition from dental surgeons thanks to its high service level. We are looking forward to supporting the incumbent management team led by Eric Darrou in the consolidation of the fragmented dental lab market in Europe and the investment in latest technologies to offer better affordable high quality dental care to patients.”

Sylvain Berger-Duquene – co-Founder and Managing Partner of Adagia Partners SAS

About Minlay

Minlay is the leader in France in the manufacturing and distribution of dental prosthetics with further presence in Germany and the Netherlands.

Positioned in the premium segment of the market, Minlay’s offer addresses all the dentist’s needs, from fixed prosthetics (to replace one or several teeth) to removable devices (to replace several or even all teeth).

Minlay brings together laboratories with the desire to continually adapt their workflow to technological developments, in order to improve the quality of dental prosthetics offered to dental surgeons, as well as the well-being of employees.

Each of the group’s laboratories keeps its own identity, but the networked structure, mutual support and sharing of best practices allows for continuous process improvement and guarantees highest customer satisfaction.

More information on: https://www.minlay.fr/

About Adagia Partners

Adagia Partners is a leading European mid-market private equity firm with offices in Paris and Frankfurt. The firm invests in Midcap companies focusing on France, DACH and Benelux. The team comprises of 17 professionals with a mix of investing and operational background.

Adagia Partners has an industry specialist approach and focusses on three core investment sectors – Healthcare, Business Services and Tech Industries. The three founding partners of Adagia Partners have a long track record of backing entrepreneurs in the implementation of their growth strategies, build-up, international expansion and Tech-Digital transformation.

More information on: https://www.adagiapartners.com/

About Motion Equity Partners

Motion Equity Partners is a long-standing mid-market private equity firm with a seasoned team of private equity professionals and more than 25 years of experience in backing French and International SMEs alongside Management teams. Motion Equity Partners has an extensive track record with more than 60 operations realised in France and abroad, actively supporting Management teams aiming at accelerating growth, change and development.

More information on: https://www.motionequitypartners.com/

Contact Adagia Partners SAS

Sylvain Berger-Duquene

20 rue Quentin Bauchart

75008 Paris

sylvain.berger-duquene@adagiapartners.com